Classic car enthusiasts and everyday drivers alike understand the value of reliable insurance coverage. But when it comes to compare classic car insurance and protecting against the dreaded “gap,” the choices can be overwhelming. That’s where we step in, helping customers like you compare classic car insurance and gap insurance from thousands of vendors to make informed decisions. In this blog, we’ll explore these two essential types of insurance, how they differ from regular coverage, and why comparing them is crucial for protecting your investment and peace of mind.

Understanding Classic Car Insurance

Classic car insurance, designed specifically for vintage and collector vehicles, is an integral part of preserving your automotive treasure. Let’s delve into what sets it apart: Classic car insurance is tailored to address the unique needs of vintage vehicles. Unlike regular auto insurance, it considers factors like age, make, model, and rarity. Some of the key features include:

1. Agreed Value Policies

One of the significant advantages of comparing classic car insurance is that it often provides an “agreed value” policy. This means that, in the event of a total loss, the insurer pays out an amount that you and the insurance company agree upon when you set up the policy. This ensures that the true value of your classic car is covered, which is typically not the case with standard auto insurance.

2. Lower Premium

Classic car insurance typically offers lower premiums compared to regular insurance. This is because classic cars are usually driven less frequently and are better maintained, reducing the likelihood of accidents.

3. Specialized Repairs and Parts

In the event of damage, classic car insurance policies often allow you to work with specialized mechanics who understand the unique needs of vintage vehicles. They may also cover the cost of sourcing rare replacement parts.

4. Mileage Limitations

Classic car insurance usually comes with mileage restrictions, as these vehicles are not intended for daily use. These limitations help keep premiums low but require you to track and report your mileage.

The Importance of Comparing Classic Car Insurance

Now that we’ve explored the specifics of classic car insurance, it’s crucial to understand why comparing different classic car insurance policies is essential:

1. Price and Coverage Variations

Classic car insurance policies can vary significantly in terms of both price and coverage. By comparing options, you can find the right balance between cost and the protection your vehicle needs.

2. Specialized Features

Different insurers offer unique features and add-ons for classic car insurance policies. Some may offer coverage for overseas transportation, while others may provide coverage during restoration work.

3. Tailored Agreed Value

The agreed value on classic car insurance policies can differ from one insurer to another. Comparing options helps you find the insurer that understands the true value of your vehicle.

4. Claims Process

Comparing insurers also allows you to assess their claims processes. Look for an insurer with a straightforward and efficient claims process, ensuring you receive a fair settlement promptly in the event of a loss.

Understanding the Basics of Gap Insurance

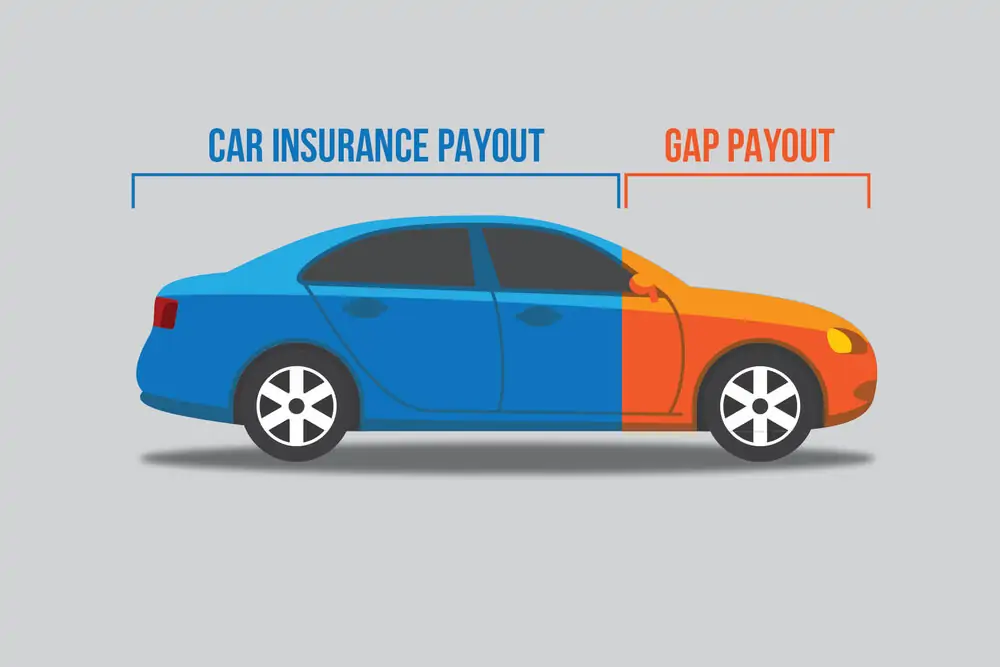

Gap insurance, or Guaranteed Asset Protection insurance, is an entirely different type of coverage designed to address the difference between your vehicle’s current value and what you owe on your auto loan or lease. Here’s what you should know about gap insurance: Gap insurance is not exclusive to classic cars but can be especially relevant if you’ve financed your vintage vehicle. It covers the “gap” between what you owe and the actual cash value of your car in case it’s totaled or stolen.

1. Protecting Your Investment

Classic cars often appreciate in value over time, whereas standard vehicles typically depreciate. Gap insurance can be essential if you’ve taken out a loan to purchase your classic car, as it ensures you won’t be left owing more than it’s worth if the worst happens.

2. Classic Car Depreciation

Understanding the specific depreciation patterns of classic cars is vital when considering gap insurance. While they generally appreciate, some circumstances might lead to a decrease in value.

3. Lease Considerations

If you’ve leased your classic car, gap insurance becomes even more critical. In the event of a total loss, it covers the difference between the insurance payout and your remaining lease balance.

Why it is Significant to Compare Gap Insurance

Now that you have a grasp of gap insurance, let’s explore why comparing different gap insurance options is crucial:

1. Coverage Levels

Gap insurance policies can have varying levels of coverage. Some may cover only the “gap” itself, while others might include additional benefits, such as covering your insurance deductible.

2. Providers

Gap insurance can be purchased from various providers, including your auto dealership or a specialized gap insurance provider. Comparing providers can help you find the most suitable rates and terms.

3. Premiums

Gap insurance premiums can differ based on the provider and the terms of your loan or lease. It’s essential to compare prices to ensure you’re not overpaying for this valuable protection.

4. Deductible Coverage

Some gap insurance policies offer coverage for your auto insurance deductible, reducing your out-of-pocket expenses in case of a claim. Comparing options can help you find the most suitable value for your needs.

Conclusion:

In a world filled with choices and complexities, we aim to simplify the process of comparing classic car insurance and gap insurance. By understanding the unique attributes of these two types of coverage and the significance of making informed decisions, you can protect your cherished classic car and your financial well-being. Remember that your classic car is more than just a vehicle; it’s a piece of history and a source of pride. Don’t settle for subpar insurance coverage; compare your options and find the protection that truly suits your needs. With our assistance, you can navigate the insurance landscape and ensure that your classic car investment is safeguarded.